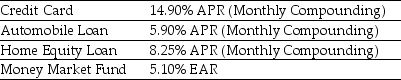

Use the table for the question(s) below.

Suppose you have the following Loans/Investments

-If your income tax rate is 30%,then the after-tax EAR for your home equity loan is closest to:

Definitions:

Interest Rate

The percentage of a loan amount charged by a lender to a borrower for the use of assets, typically expressed as an annual percentage.

Miller-Orr Model

A financial model used for managing cash flows and cash reserves, focusing on maintaining balances within certain limits at minimum cost.

Upper Limit

The maximum value or level that is allowed or attainable in a given situation.

Miller-Orr Model

A financial model used to manage cash balances by setting upper and lower limits on cash reserves within which no financing is needed.

Q1: You overhear your manager saying that she

Q25: Which of the following statements is FALSE?<br>A)The

Q27: The brand equity of many oil companies

Q31: You are considering investing $600,000 in a

Q32: Larry should:<br>A)reject the offer because the NPV

Q39: Assume that you presently have a monthly

Q40: Which of the following statements is FALSE?<br>A)Estimating

Q61: Given Nielson's current share price,if Nielson's equity

Q86: Which of the following statements is FALSE?<br>A)The

Q87: You are offered an investment opportunity in