Use the information for the question(s)below.

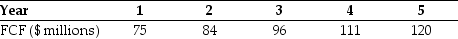

You expect DM Corporation to generate the following free cash flows over the next five years:  Beginning with year six,you estimate that DM's free cash flows will grow at 6% per year and that DM's weighted average cost of capital is 15%.

Beginning with year six,you estimate that DM's free cash flows will grow at 6% per year and that DM's weighted average cost of capital is 15%.

-If DM has $500 million of debt and 14 million shares of stock outstanding,then what is the price per share for DM Corporation?

Definitions:

Insightful Questions

Questions that are designed to elicit deep understanding, revealing underlying motives or the essence of an issue.

Supplemental Material

Additional information or documents provided to support or enhance the main content.

Stress Of Interview

The anxiety or nervousness one experiences before, during, or after a job interview or similar evaluative situation.

Stock Questions

Pre-prepared or standard questions often used in interviews, surveys, or research to elicit consistent information across different respondents.

Q2: Assume that Kinston's new machine will be

Q5: What rating must Luther receive on these

Q24: Which of the following statements regarding portfolio

Q31: The equity cost of capital for "Miney"

Q58: The difference between scenario analysis and sensitivity

Q60: What is the excess return for Treasury

Q66: At an annual interest rate of 7%,the

Q74: Using just the return data for 2008,your

Q92: Which of the following statements is FALSE?<br>A)A

Q96: Which of the following statements is FALSE?<br>A)In