Use the information for the question(s) below.

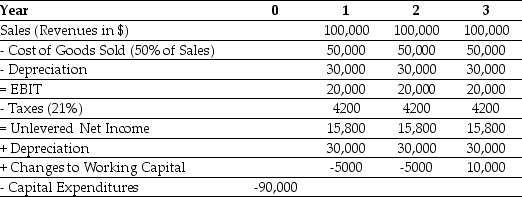

Epiphany Industries is considering a new capital budgeting project that will last for three years.Epiphany plans on using a cost of capital of 12% to evaluate this project.Based on extensive research,it has prepared the following incremental cash flow projections:

-Epiphany would like to know how sensitive the project's NPV is to changes in the discount rate.How much can the discount rate vary before the NPV reaches zero?

Definitions:

Diagnostic Overshadowing

The problem of attributing emotional and behavioural difficulties of people with intellectual disability to the developmental disorder, causing real psychiatric disorders to be missed. The fact is that such people can develop all types of psychiatric disorders, including less common ones.

Neurodevelopmental Disorder

A group of conditions that impair the growth and development of the brain or central nervous system.

Deviant Behaviours

Actions or behaviors that violate societal norms or expectations, potentially eliciting disapproval or sanctions.

Dignity of Risk

The concept that allowing individuals, particularly those with disabilities, the right to take certain risks is crucial for their empowerment and autonomy.

Q3: The price per share of this ETF

Q19: What is the standard deviation of Big

Q26: Consider an ETF that is made up

Q39: Suppose you have $1000 today and the

Q50: Dustin's Donuts experienced a decrease in the

Q59: According to Figure 6.5 in the text,the

Q63: The price today of a 3-year default-free

Q79: When we express the value of a

Q89: The Volatility on Stock Z's returns is

Q89: If the interest rate is 7%,the NPV