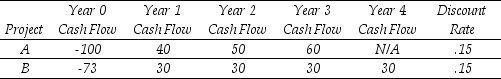

Use the table for the question(s) below.

Consider the following two projects with cash flows in $:

-The maximum number of IRRs that could exist for project B is:

Definitions:

AGI

Adjusted Gross Income (AGI) is a measure of income calculated from your gross income and allows for certain deductions, serving as a basis for calculating taxable income.

Dependent Child

A child who relies on their parent or guardian for more than half of their financial support and meets certain IRS criteria for tax purposes.

Foreign Tax Credit

A tax credit that cannot be refunded for income taxes paid to an external government due to withholdings from foreign income tax.

Foreign Income Taxes

Taxes paid to a foreign government for income earned outside of the taxpayer's resident country.

Q9: Your estimate of the asset beta for

Q15: Hugh Akston took out a 30-year mortgage

Q17: Assume that Kinston's new machine will be

Q34: How much will each semiannual coupon payment

Q42: What is the market portfolio?

Q66: The incremental unlevered net income of the

Q68: The British government has a consol bond

Q78: The price you would be willing to

Q90: Which of the following equations is INCORRECT?<br>A)Var(R)=

Q114: The expected return on your investment is