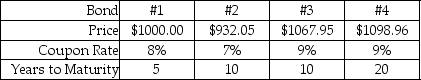

Use the following information to answer the question(s) below.Consider the following four corporate bonds that have semiannual compounding:

-If the YTM of these bonds increased to 9%,which bond's price would be most sensitive to this change in YTM?

Definitions:

Obedience

A form of social influence where an individual acts in response to a direct order from another individual, usually an authority figure.

Persuasion

The act or process of influencing someone's beliefs, attitudes, or behaviors through argument, reasoning, or appeal.

Groupthink

A behavioral pattern observed in groups where the pursuit of agreement or uniformity leads to choices that are illogical or counterproductive.

Challenger Disaster

The catastrophic failure of the Space Shuttle Challenger shortly after its launch on January 28, 1986, leading to the death of all seven crew members.

Q10: Should the nominal interest rate ever be

Q17: Paterson Inc.is a business that purchases computers,printers,modems,fax

Q21: Suppose that a security with a risk-free

Q28: Which of the following statements is FALSE?<br>A)We

Q52: Which of the following statements is FALSE?<br>A)The

Q54: When using the internal rate of return

Q66: The IRR for this project is closest

Q89: The depreciation tax shield for the Sisyphean

Q92: Which of the following formulas is INCORRECT?<br>A)P0

Q104: Taggart Transcontinental has issued at par a