Use the following information to answer the question(s) below.

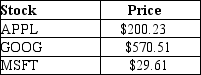

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks.Consider an ETF for which each share represents a portfolio of two shares of Apple Inc.(APPL) ,one share of Google (GOOG) ,and ten shares of Microsoft (MSFT) .Suppose the current stock prices of each individual stock are as shown below:

-Suppose that a security with a risk-free cash flow of $1000 one year from now trades for $930 today.If there are no arbitrage opportunities,then the current risk-free rate is closest to:

Definitions:

Stockholders' Equity

Stockholders' Equity is the residual interest in the assets of a corporation after deducting its liabilities, indicating the ownership interest of the shareholders.

Trading Portfolio

A collection of financial assets such as stocks, bonds, commodities, currencies, and derivatives, actively managed and traded to achieve short-term financial gains.

Fair Value Adjustment

A financial process that alters the reported value of an asset or liability to reflect its current market value.

Common Stock C

A classification of common stock that may have specific rights, privileges, or restrictions compared to other classes.

Q5: Once the market share has exceeded the

Q5: A(n)_ strategy presents a generic value proposition

Q9: If in 2019 Luther has 10.2 million

Q10: The credit spread of the B corporate

Q27: The brand equity of many oil companies

Q30: Church & Dwight,Co.is a U.S.manufacturer of household

Q44: Zoe Dental Implements has gross property,plant and

Q74: Which of the following statements is FALSE?<br>A)Because

Q85: Assuming that your capital is constrained,which project

Q96: Which of the following is (are)deducted from