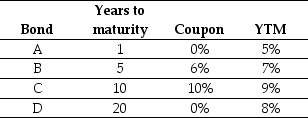

Use the table for the question(s) below.

Consider the following four bonds that pay annual coupons:

-The percentage change in the price of the bond "A" if its yield to maturity increases from 5% (Price0) to 6% (Price1) is closest to:

Definitions:

Technological Base

Refers to the foundation of technology, including the knowledge, tools, and processes that support the economic and industrial development of a country or region.

Foreign Aid

Financial or material assistance provided by one country to another, often for developmental purposes.

Private Channels

Means of communication or distribution that are owned and operated by non-governmental entities.

International Monetary Fund

An international organization created for the purpose of fostering global monetary cooperation, securing financial stability, facilitating international trade, promoting high employment, and sustainable economic growth, and reducing poverty.

Q9: Which of the following statements is FALSE?<br>A)Because

Q13: What is the expected payoff for Little

Q15: If Alex Corporation takes out a bank

Q20: The profitability index for project A is

Q49: The internal rate of return (IRR)for project

Q50: Should you purchase the delivery truck or

Q52: The price of a five-year,zero-coupon,default-free security with

Q68: The decision you should take regarding this

Q84: Assume that the YTM increases by 1%

Q96: If CCM has $150 million of debt