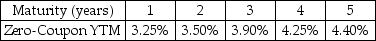

Use the following information to answer the question(s) below.

-The price today of a three-year default-free security with a face value of $1000 and an annual coupon rate of 4% is closest to:

Definitions:

Moral Hazard

The situation where one party in an agreement is tempted to take undue risks because the negative consequences of the risk will be suffered by the other party.

Efficient Level

The optimal point of production or operation where costs are minimized and productivity or utility is maximized.

Warranty

A guarantee, usually made by a seller to a buyer, promising to repair or replace a product if necessary within a specified period.

High Quality

The standard of something as measured against other similar things, indicating it is of superior grade.

Q7: The YTM of a 4-year default-free security

Q11: How is the optimal portfolio choice affected

Q39: In terms of present value,how much will

Q48: Assuming that the risk-free rate is 4%

Q49: A default-free security has an annual coupon

Q54: When using the internal rate of return

Q70: You are considering investing in a zero

Q74: The NPV of project B is closest

Q92: Details of acquisitions,spin-offs,leases,taxes,and risk management activities are

Q94: Monsters Inc.is a utility company that recently