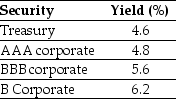

Use the table for the question(s) below.

Consider the following yields to maturity on various one-year zero-coupon securities:

-The credit spread of the B corporate bond is closest to:

Definitions:

Philadelphia

A city in Pennsylvania, United States, significant for its historical importance in American independence and as the location of the first and second Continental Congresses.

Kansas-Nebraska Act

A piece of legislation passed by the U.S. Congress in 1854 that allowed inhabitants of Kansas and Nebraska territories to decide whether to allow slavery, leading to significant political and social conflict.

Popular Sovereignty

A principle that the authority of a state and its government are created and sustained by the consent of its people, through their elected representatives.

Q2: Perrigo's enterprise value is closest to:<br>A)$952.16 million.<br>B)$3580.14

Q5: Advanced Micro Devices (NYSE: AMD)is currently trading

Q11: Taggart Transcontinental currently has a bank loan

Q47: A 3-year default-free security with a face

Q54: An American Depository Receipt (ADR)is a security

Q59: The standard deviation of the return on

Q66: Which of the four bonds is the

Q72: Which of the following statements is FALSE?<br>A)Given

Q81: Construct a simple income statement showing the

Q113: Consider a bond that pays annually an