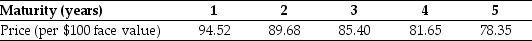

Use the table for the question(s) below.

The following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of face value) :

-The yield to maturity for the three-year zero-coupon bond is closest to:

Definitions:

Issued Price

The price at which a new security is offered to the public for the first time.

Market Rate of Return

The average return on investment that is typical for a particular market or industry.

T-bill

Short-term government securities issued at a discount from the face value and maturing at par, used to finance government debt.

Issue Date

The specific date on which a financial instrument is issued or becomes effective.

Q7: Which of the following statements is FALSE?<br>A)The

Q10: Should the nominal interest rate ever be

Q31: Which of the following is NOT an

Q33: Consider an ETF that is made up

Q34: Indirect channels are able to achieve the

Q35: If ECE's net profit margin is 8%,then

Q42: You are up late watching TV one

Q46: Suppose that of the 60% of FFL's

Q48: Which of the following statements is FALSE?<br>A)The

Q62: The standard deviation of the overall payoff