Multiple Choice

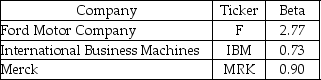

Use the following information to answer the question(s) below.

-If the expected return on the market is 11% and the risk-free rate is 4%,then the expected return of investing in IBM is closest to:

Definitions:

Related Questions

Q1: Which of the following statements is FALSE?<br>A)The

Q30: The expected alpha for Wyatt Oil is

Q35: Which of the following statements is FALSE?<br>A)Margin

Q43: The market value of Luther's non-cash assets

Q72: An individual's desire for intense risk-taking experiences

Q77: Which pharmaceutical company faces less risk?

Q77: Consider the following equation: E + D

Q81: Construct a simple income statement showing the

Q82: Suppose that you want to use the

Q85: Von Bora Corporation (VBC)is expected to pay