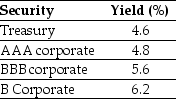

Use the table for the question(s) below.

Consider the following yields to maturity on various one-year zero-coupon securities:

-The credit spread of the B corporate bond is closest to:

Definitions:

Instrumental Functioning

Instrumental functioning refers to the skills and activities required for daily living, often used to assess individuals’ capacity for self-care and independence.

Insulin Injections

A treatment method involving the administration of insulin via injections to manage and control blood sugar levels in individuals with diabetes.

Hypoglycemic Reactions

Adverse responses caused by a significant drop in blood sugar levels, which can include symptoms such as dizziness, sweating, and confusion.

Positive Response

A favorable reaction to a treatment or medication, indicating effectiveness or improvement in the patient's condition.

Q10: The internal rate of return (IRR)for project

Q23: Another oil refiner is offering to trade

Q24: Which of the following statements is FALSE?<br>A)Beta

Q31: You are considering investing $600,000 in a

Q34: Assuming you pay the points and borrow

Q36: If we use future value rather than

Q42: The present value (at age 30)of your

Q60: Nielson Motors has a share price of

Q69: Luther Corporation's stock price is $39 per

Q94: If the market risk premium is 6%