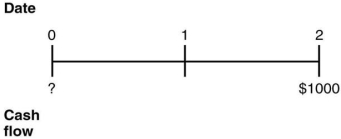

Consider the following time line:  If the current market rate of interest is 8%,then the present value of the cash flows on this timeline is closest to:

If the current market rate of interest is 8%,then the present value of the cash flows on this timeline is closest to:

Definitions:

Incremental Borrowing Rate

The interest rate a company would have to pay if it borrows funds, used as a benchmark in lease agreements to calculate the present value of minimum lease payments.

Balance Sheet

A financial statement that shows a company's assets, liabilities, and shareholders' equity at a specific point in time.

Liability

Financial obligations or debts owed by a business to others, which must be settled over time through the transfer of economic benefits.

Cash Flows

The inflows and outflows of cash and cash equivalents, reflecting the operational, investing, and financing activities of a business.

Q26: If the discount rate for project B

Q30: On the balance sheet,current maturities of long-term

Q30: The present value of receiving $1000 per

Q38: Which of the following statements regarding annuities

Q42: The present value (at age 30)of your

Q42: In which of the following situations would

Q48: Rearden's expected capital gains yield is closest

Q53: As a business adds more products to

Q55: The statement of financial position is also

Q87: Which of the following adjustments is NOT