Use the information for the question(s) below.

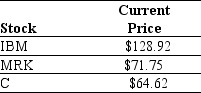

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks.Consider an ETF for which each share represents a portfolio of two shares of International Business Machines (IBM) ,three shares of Merck (MRK) ,and three shares of Citigroup Inc.(C) .Suppose the current market price of each individual stock are shown below:

-The price per share of the ETF in a normal market is closest to:

Definitions:

Centers For Medicare And Medicaid Services

A federal agency within the United States Department of Health and Human Services that administers the nation’s major healthcare programs, namely Medicare, Medicaid, and the Children's Health Insurance Program (CHIP).

National Hospital Association

An organization that represents the interests of hospitals and health systems across a particular nation, focusing on policy advocacy, education, and best practices.

General Equivalence Mappings

A system used in healthcare to convert ICD-9 to ICD-10 coding, ensuring an accurate transition of medical data across different coding systems.

ICD-9-CM/PCS

International Classification of Diseases, 9th Revision, Clinical Modification/Procedure Coding System; a set of codes used for diagnosing and classifying diseases before being replaced by ICD-10.

Q2: Name and describe the three different types

Q8: When the total contribution produced by a

Q11: Which of the following statements regarding the

Q18: MyStyle Clothes Inc.is a women's fashion apparel

Q21: When choosing between projects,an alternative to comparing

Q24: Which of the following statements is FALSE?<br>A)Because

Q29: For a segment marketing mix strategy to

Q30: The present value of receiving $1000 per

Q40: Mixed channel systems are unsuitable for marketing

Q63: Which of the following formulas is INCORRECT?<br>A)i