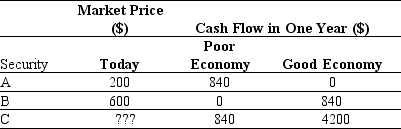

Use the table for the question(s) below.

-Suppose a risky security pays an average cash flow of $100 in one year.The risk-free rate is 5%,and the expected return on the market index is 13%.If the returns on this security are high when the economy is strong and low when the economy is weak,but the returns vary by only half as much as the market index,then the price for this risky security is closest to:

Definitions:

Problem Solving Strategies

Various methods or techniques adopted to find solutions to problems, ranging from systematic analyses to more intuitive approaches.

Taking a Break

Involves pausing from work or activities for relaxation or rest, which can improve productivity and well-being.

Unconscious Processing

Cognitive processes that occur without consciousness or awareness, influencing thoughts, feelings, and behaviors without the individual's explicit understanding.

Bird Songs

Vocalizations produced by birds, which can serve various functions including territorial defense, attraction of mates, and communication of environmental cues.

Q13: Dagny Taggart is a graduating college senior

Q25: You have an investment opportunity in Germany

Q26: Which of the following statements is FALSE?<br>A)On

Q31: In which of the following situations is

Q31: You are considering investing $600,000 in a

Q44: Market-based pricing is not possible without extensive

Q47: Which of the following statements is FALSE?<br>A)The

Q71: Plot the zero-coupon yield curve (for the

Q80: Consider a zero-coupon bond with 20 years

Q115: Which of the following statements is FALSE?<br>A)Investors