Use the information for the question(s) below.

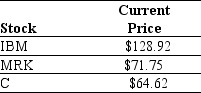

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks.Consider an ETF for which each share represents a portfolio of two shares of International Business Machines (IBM) ,three shares of Merck (MRK) ,and three shares of Citigroup Inc.(C) .Suppose the current market price of each individual stock are shown below:

-Suppose a security with a risk-free cash flow of $1000 one year from now trades for $909 today.If there are no arbitrage opportunities,then the current risk-free interest rate is closest to:

Definitions:

Globalization

The process of interaction and integration among people, companies, and governments worldwide, often driven by international trade and investment and aided by informational technology.

Diversity Initiatives

Programs and policies designed to promote and support inclusivity and diversity within workplaces or communities.

Canadian Charter

Short for the Canadian Charter of Rights and Freedoms, a bill of rights entrenched in the Constitution of Canada.

Constitution Act Of 1982

A significant update to the Canadian constitution that included the Charter of Rights and Freedoms, fundamentally shaping Canadian law.

Q15: Market-based pricing does not consider what the

Q19: _ are tools that marketing managers use

Q25: Which of the following statements is FALSE?<br>A)The

Q31: What is the shape of the yield

Q33: Compared to a direct marketing channel,an indirect

Q37: If the appropriate interest rate is 10%,then

Q68: In addition to the balance sheet,income statement,and

Q74: Which of the following statements is FALSE?<br>A)Because

Q78: Wyatt Oil is contemplating issuing a 20-year

Q81: The payback period for project B is