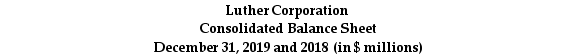

Use the table for the question(s)below.

Consider the following balance sheet:

-If on December 31,2018 Luther has 8 million shares outstanding trading at $15 per share,then what is Luther's enterprise value?

Definitions:

Book Value Method

A method of valuing assets or liabilities at their original cost minus any depreciation, amortization, or impairment charges.

Market Value Method

A valuation technique that determines the price an asset would fetch in the marketplace or the value of a company based on the current market price of its shares.

Convertible Bonds

Bonds that can be converted into a predetermined number of the issuing company's shares.

U.S. GAAP

Generally Accepted Accounting Principles in the United States, which are a set of rules and standards for financial reporting.

Q4: Which of the following forces that shape

Q5: An oblique strategy differs from a reactive

Q7: Which of the following statements is FALSE?<br>A)The

Q36: If we use future value rather than

Q41: A plus-one market-based pricing strategy means a

Q45: Which of the following statements is FALSE?<br>A)The

Q56: What is the price today of a

Q79: If the appropriate discount rate for this

Q83: The internal rate of return (IRR)for project

Q114: Assuming the appropriate YTM on the Sisyphean