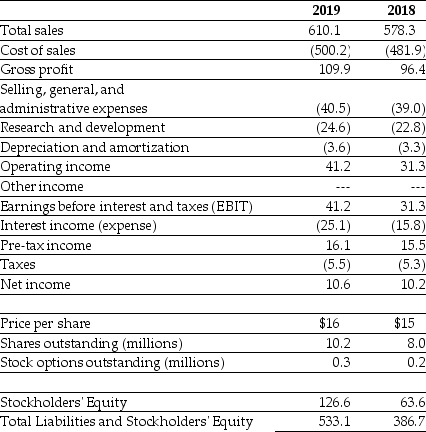

Use the table for the question(s) below.

Consider the following income statement and other information:

Luther Corporation

Consolidated Income Statement

Year ended December 31 (in $ millions)

-For the year ending December 31,2019 Luther's earnings per share are closest to:

Definitions:

Hardware Maintenance

The routine servicing and repairs of physical computer and electronic equipment to ensure their proper functioning.

Power Source

Refers to the origin of power that supplies energy for electrical devices, which can range from batteries to electrical outlets.

Horizontal Lines

Lines that run left to right and are parallel to the horizon, often used for separation, emphasis, or decoration in design.

Video Card

An expansion card in a computer that generates and outputs images to a display device; critical for rendering visuals, especially in gaming and graphic design.

Q5: The total amount of principal that Dagny

Q8: A positive NMC is the result of

Q10: The credit spread of the B corporate

Q18: In a normal market with transactions costs,is

Q27: Which of the following organization forms accounts

Q33: One key benefit provided by a broad

Q35: McCann Chemicals is a multinational pharmaceutical company

Q43: Which of the following formulas is INCORRECT?<br>A)Invoice

Q49: Which of the following is a customer

Q50: Should you purchase the delivery truck or