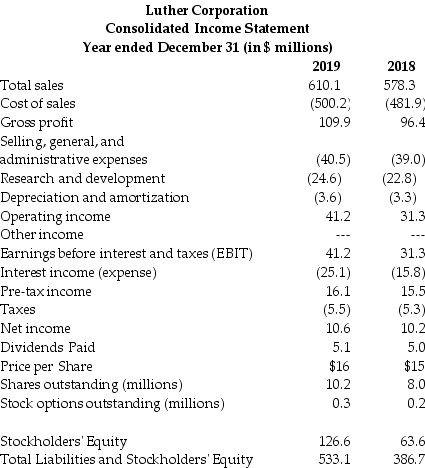

Use the tables for the question(s) below.Consider the following financial information:

Luther Corporation

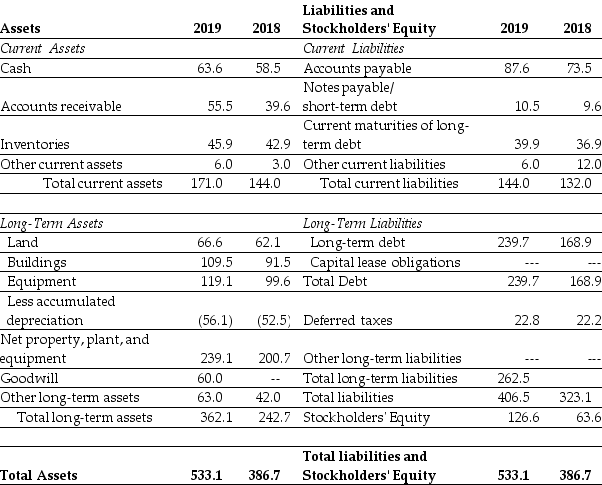

Consolidated Balance Sheet

December 31,2019 and 2018 (in $ millions)

-For the year ending December 31,2019 Luther's cash flow from operating activities is:

Definitions:

Unrealised Profit

Profit that has been generated on paper due to accounting entries but has not been realized through cash or other assets.

Retained Earnings

The portion of net earnings not paid out as dividends but retained by the company to be reinvested in its core business or to pay debt.

Cost Of Goods Sold

The total cost involved in manufacturing or acquiring the products that a company has sold during a specific period.

Investment

Allocation of resources, such as capital or time, in anticipation of generating income or profit in the future.

Q16: If a business fails to deliver acceptable

Q35: Every marketing channel is basically the same

Q47: Which of the following statements regarding the

Q54: The amount of money that would be

Q55: When a market reaches the maturity stage

Q57: Calculate the market potential of Royston light

Q71: Plot the zero-coupon yield curve (for the

Q72: Suppose that the ETF is trading for

Q81: The payback period for project B is

Q89: Which of the following statements is FALSE?<br>A)The