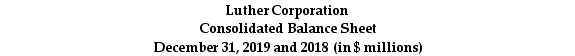

Use the table for the question(s) below.

Consider the following balance sheet:

-If in 2019 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share,then using the market value of equity,the debt to equity ratio for Luther in 2009 is closest to:

Definitions:

Withholding Table

A chart or table used by employers to determine the amount of tax to withhold from an employee's paycheck based on earnings and tax status.

Interest-Bearing Note

A debt instrument that pays interest to the holder at a fixed or variable rate over a specified period.

Interest Expense

The cost incurred by an entity for borrowed funds, considered a non-operating expense on the income statement.

Notes Payable

A formal written agreement in which one party agrees to pay another a specific sum of money, either on demand or at a determined future date.

Q19: _ are tools that marketing managers use

Q20: When the management team noted the increased

Q37: Name and describe four of the six

Q40: The IRR of Palin's book deal is

Q45: The highest effective rate of return you

Q47: Calculate the number of transactions made per

Q52: Which of the following statements is FALSE?<br>A)The

Q59: _ is the ratio of the percentage

Q71: Which of the following is NOT a

Q91: You are considering investing in a security