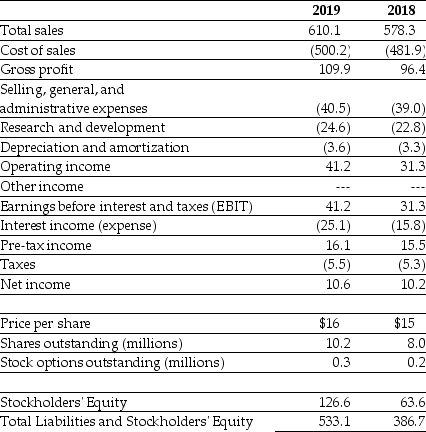

Use the table for the question(s) below.

Consider the following income statement and other information:

Luther Corporation

Consolidated Income Statement

Year ended December 31 (in $ millions)

-Wyatt Oil has a net profit margin of 4.0%,a total asset turnover of 2.2,total assets of $525 million,and a book value of equity of $220 million.Wyatt Oil's current return-on-assets (ROA) is closest to:

Definitions:

Perfect Competition

A market structure characterized by a large number of small firms, homogeneous products, and free entry and exit, making firms price takers.

Average Total Cost

The total cost of production divided by the quantity produced, indicating the average cost of producing each unit of output.

Profit Maximization

The process by which a firm determines the price and output level that returns the greatest profit, considering costs and market demand.

Short-Run Supply Curve

A graphical representation showing the relationship between the market price of a good and the quantity supplied by producers in the short term.

Q3: Crowdsourcing differs from mass collaboration in that

Q5: What type of company trades on an

Q6: The payback period for project Alpha is

Q23: Which of the following is an operational

Q33: A company has an operating income of

Q36: If you buy shares of Coca-Cola on

Q37: Chloe Floral Company had segment earnings as

Q41: The yield to maturity for the two-year

Q56: Which of the following statements is FALSE?<br>A)If

Q62: You are offered an investment that pays