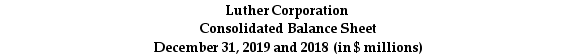

Use the table for the question(s) below.

Consider the following balance sheet:

-Luther Corporation's stock price is $39 per share and the company has 20 million shares outstanding.Its Debt -Capital Ratio for 2019 is closest to:

Definitions:

Debt Financing

Involves borrowing funds from external sources to finance business operations or expand capital, typically through loans or issuing bonds.

Equity Financing

Equity financing is the process of raising capital through the sale of shares in an entity, giving investors ownership interests in the company.

Average Collection Period

The average number of days it takes for a company to collect its accounts receivable after a sale has been made.

Credit Terms

Conditions under which credit will be extended to a borrower, including repayment terms, interest rates, and due dates.

Q11: You own 100 shares of a "C"

Q17: The statement of financial performance is also

Q25: Assuming that college costs continue to increase

Q27: Which of the following is true of

Q31: What is the shape of the yield

Q47: Which of the following statements regarding the

Q49: You are considering purchasing a new home.You

Q53: Which of the following terms refers to

Q61: On the balance sheet,short-term debt appears:<br>A)in the

Q82: If your new strip mall will have