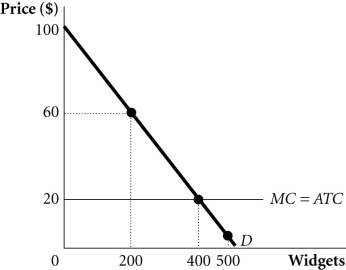

Refer to the information provided in Figure 13.11 below to answer the question(s) that follow.  Figure 13.11

Figure 13.11

-Refer to Figure 13.11. Suppose a monopolist faces the demand and costs in the figure and is able to perfectly price discriminate. What is the value of the deadweight loss?

Definitions:

Tax Incidence

The analysis of the effect of a particular tax on the distribution of economic welfare, indicating who ultimately bears the burden of the tax.

Tax Burden

The tax burden refers to the total amount of taxes that individuals, businesses, or other entities must pay, expressed as a percentage of income or GDP.

Tax Burden

The overall impact of taxes on an individual's, corporation's, or economy's financial performance and well-being.

Tax Imposed

A financial charge or levy instituted by governmental authorities on individuals, transactions, or properties to generate revenue.

Q9: Refer to Figure 12.1. The firm is<br>A)

Q52: Suppose there is a permanent shift of

Q73: Clean air is an example of a

Q104: When resources are misallocated, or allocated inefficiently,<br>A)

Q132: Refer to Figure 12.5. A firm produces

Q178: Assume the current interest rate is 25%.

Q180: Antitrust cases against Eastman Kodak, International Harvester,

Q182: You use $40,000 of your own money

Q196: The _ is(are) empowered to impose a

Q343: An oligopoly is an industry market structure