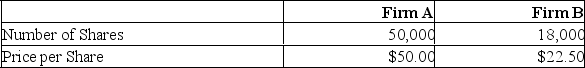

Suppose you have the following information concerning an acquiring firm (A) and a target firm (B) . Neither firm has any debt. The incremental value of the acquisition is estimated to be $250,000. Firm B is willing to be acquired for $540,000 worth of Firm A's stock.  What is the price per share of the existing firm after the acquisition is completed?

What is the price per share of the existing firm after the acquisition is completed?

Definitions:

Total Lung Capacity

The maximum amount of air the lungs can hold, including inspiratory and expiratory reserve volumes and the tidal volume.

Capillaries

The smallest blood vessels in the body, which facilitate the exchange of water, oxygen, carbon dioxide, and many other nutrient and waste substances between blood and surrounding tissues.

Alveoli

Clusters of air sacs in which the exchange of gases between air and blood takes place; located in the lungs.

Bronchioles

A part of the respiratory tract that branches from the tertiary bronchi.

Q5: Synergistic benefits can often be realized by

Q40: Your company is considering the purchase of

Q95: Asset write-ups refers to synergistic gains due

Q105: In an operating lease, the lessor is

Q159: Alito Storage is debating between purchasing some

Q188: Triangle arbitrage only involves currencies other than

Q219: S&P 500 INDEX (CME); $500 times index

Q237: You sold (wrote) a May American put

Q262: The value of firm B to firm

Q265: Firm A is acquiring Firm B for