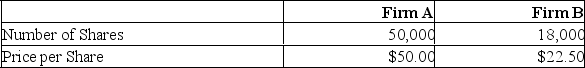

Suppose you have the following information concerning an acquiring firm (A) and a target firm (B) . Neither firm has any debt. The incremental value of the acquisition is estimated to be $250,000. Firm B is willing to be acquired for $540,000 worth of Firm A's stock.  What is the price per share of the existing firm after the acquisition is completed?

What is the price per share of the existing firm after the acquisition is completed?

Definitions:

Q49: Your firm needs to either buy or

Q69: If a firm enters a sale and

Q70: At one time, exchange rates were more

Q89: Provide a definition of an operating lease.

Q94: Jones Men's Wear needs to buy some

Q99: Saturn, Inc. is trying to decide whether

Q100: A lease in which a company purchases

Q135: Daily Enterprises is contemplating the acquisition of

Q216: You are the purchasing agent for a

Q231: For forward contracts, the payoff profile for