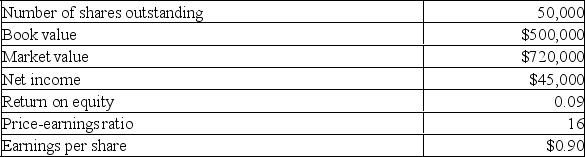

The Jenkins Co. is considering a project which requires the purchase of $315,000 of fixed assets. The net present value of the project is $20,000. Equity shares will be issued as the sole means of financing the project. The price-earnings ratio of the project equals that of the existing firm. What will the new market value per share be after the project is implemented given the following current information on the firm?

Definitions:

Tie-In Sales

A sales technique where the purchase of one product requires the purchase of another product as well.

Exclusive Agreements

Contracts that restrict parties from engaging in similar agreements with others, often used in distribution or partnership scenarios.

Exclusive Dealership

A business agreement in which a supplier grants a retailer the right to be the sole seller of its product or service in a specific geographical area.

Price Discrimination

The strategy of selling the same product or service at different prices to different customers, based on factors like location, customer segment, or purchase volume.

Q9: Gail's Dance Studio is currently an all

Q30: Provide a definition for the term stock

Q35: Donnelly and Son pay $8 as the

Q86: The legal document describing details of the

Q115: In regards to the cost of issuing

Q119: Which of the following best defines the

Q149: The Miller Brothers Co. wants to expand

Q204: The financial strength of the venture capitalist

Q258: Which one of the following statements concerning

Q310: A firm has total debt of $900