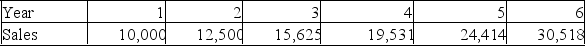

A project requires an initial fixed asset investment of $600,000, which will be depreciated straight-line to zero over the six-year life of the project. The pre-tax salvage value of the fixed assets at the end of the project is estimated to be $50,001. Projected sales volume for each year of the project is shown below. The sale price is $50 per unit for the first three years, and $45 per unit for years 4 through 6. A $30,000 initial investment in net working capital is required, with additional investments equal to 7.5% of annual sales for each year of the project. Variable costs are $35 per unit, and fixed costs are $50,000 per year. The firm has a tax rate of 34% and a required return on investment of 12%.  What is the operating cash flow during year 5 of the project?

What is the operating cash flow during year 5 of the project?

Definitions:

Parcel of Land

A specific piece of land, defined by boundaries, that can be owned or bought.

Capital Gain

The profit from the sale of assets or investments, such as stocks or real estate, which exceeds the purchase price.

Gift

A voluntary transfer of property or funds from one person to another without receiving anything in return, or at least without expecting a return equal to the value of the gift.

Short-Term Capital Loss

A financial loss realized on the sale of securities or assets held for one year or less, which can be used to offset capital gains for tax purposes.

Q9: If the DOL = 1.05 and OCF

Q21: Ski World is considering a new product

Q25: Machinery and equipment can be depreciated for

Q37: The payback period is defined as the

Q49: The managers of PonchoParts, Inc. plan to

Q146: What is the contribution margin for a

Q179: Which of the following is NOT considered

Q193: The managers of PonchoParts, Inc. plan to

Q280: The Monumental Co. is considering purchasing a

Q362: A project produces annual net income of