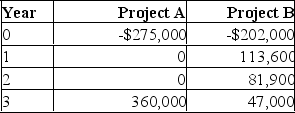

You are considering two mutually exclusive projects with the following cash flows. Which project(s) should you accept if the discount rate is 7 %? What if the discount rate is 10 %?

Definitions:

Tax Rate

The chunk of income designated by the government to be taken as tax from corporations or the public.

CCA Rate

Capital Cost Allowance rate, which is the percentage rate at which Canadian businesses can claim depreciation on assets for tax purposes.

Operating Cash Flow

The amount of cash generated by a company's regular business operations, indicating its ability to pay bills and fund operations.

Depreciation

A method to allocate a portion of the original cost of an asset to expense over its expected useful life to reflect its decreasing value.

Q54: A stock that pays a constant dividend

Q135: Which of the following is the best

Q158: The discount rate that makes the net

Q182: Which of the following is calculated using

Q198: Given the following project information and assuming

Q293: You are considering two mutually exclusive projects

Q329: The New Blues Co. is considering two

Q332: Shares of Blue Dye, Inc. are currently

Q349: Which one of the following statements is

Q375: Energistics, Inc. plans to retain and reinvest