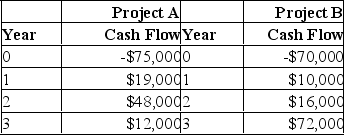

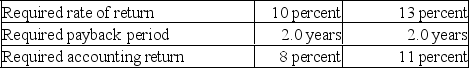

You are considering the following two mutually exclusive projects. Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project. Neither project has any salvage value.

Based upon the payback period and the information provided in the problem, you should:

Based upon the payback period and the information provided in the problem, you should:

Definitions:

Form 940

An IRS form used by employers to report their annual Federal Unemployment Tax Act (FUTA) tax.

Form 941

A federal tax form used by employers to report quarterly federal income tax withheld from employees' paychecks and FICA taxes.

FICA

The Federal Insurance Contributions Act tax, which funds Social Security and Medicare, requiring both employer and employee contributions.

Form 941

A quarterly federal tax form filed by employers to report income taxes, social security tax, or Medicare tax withheld from employees' paychecks.

Q58: The future rental income that could have

Q66: You are considering the following two mutually

Q129: You are considering an investment with the

Q129: If a company has a current stock

Q135: You are going to choose between two

Q247: A project will increase sales by $640,000

Q269: The internal rate of return is defined

Q307: A project will increase the sales of

Q310: The cash flow tax savings generated as

Q389: A project which has an initial cash