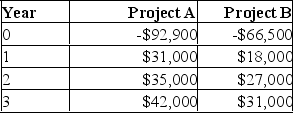

Yuli is analyzing the following two mutually exclusive projects and has developed the following cash flow information. What is the crossover rate?

Definitions:

Weighted Average Flotation Cost

The average cost of issuing new securities, weighed by the proportion each method of financing contributes to the total new financing, considering costs like underwriting fees and legal expenses.

Flotation Costs

The costs a company faces when issuing new securities, including fees for underwriting, legal services, and registration.

Net Present Value

The value of all future cash flows from a project or investment adjusted to their present value using a discount rate.

Tax Rate

The percentage at which an individual or corporation is taxed, which can vary depending on income level or earnings before taxes.

Q153: Talon Corp. just paid a dividend of

Q159: A project will produce operating cash flows

Q186: The discounted payback rule states that you

Q203: Daily Movers is a relatively new firm.

Q243: You will bid to supply three jets

Q263: Super Sounds is expecting a period of

Q265: A project requires an initial fixed asset

Q309: If a company has a current stock

Q336: Baker Foods made two announcements concerning its

Q382: The length of time required for an