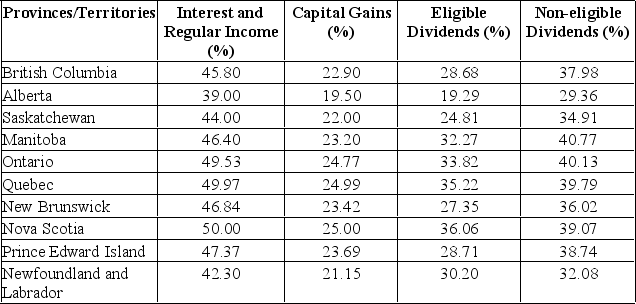

A Saskatchewan resident earned $40,000 in interest income and $60,000 in eligible dividends. Calculate the average tax rate.

Definitions:

Fee Simple

The most complete ownership interest one can hold in real property, with the freedom to use it, sell it, or bequeath it, under the laws of the jurisdiction.

Financial Difficulties

Financial difficulties are situations where an individual or entity is unable to meet financial obligations due to lack of resources, impacting their economic stability.

Residential Property

Property designated for living purposes, such as houses, apartments, condos, and other dwellings where individuals or families reside.

Mortgage

A legal agreement where a bank or lender lends money at interest in exchange for taking title of the debtor's property, with the condition that the conveyance of title becomes void upon the payment of the debt.

Q64: Common stockholders or limited partners can lose,

Q170: If depreciation is added back to operating

Q178: Calculate the tax difference between a

Q186: Tasks related to tax management, cost accounting,

Q213: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" If a company

Q235: The decisions made by financial managers should

Q254: Conceptually, capital cost allowance (CCA) is equivalent

Q340: List and interpret three liquidity ratios.

Q397: A Halifax firm has an interval measure

Q404: What is the proper measure of cash