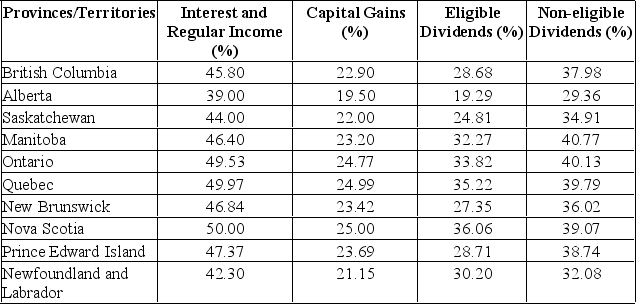

Calculate the tax difference between a British Columbia resident and an Alberta resident both having $20,000 in interest income and $25,000 in capital gains.

Definitions:

Object Permanence

Object permanence is the understanding that objects continue to exist even when they cannot be seen, heard, or otherwise sensed, a concept crucial in cognitive development of infants.

Conservation

Conservation refers to the principle in cognitive psychology that certain physical characteristics of objects remain the same even when their outward appearance changes.

Ego Centrism

A cognitive bias where an individual perceives, interprets, and judges the world primarily from their own perspective.

Secure Attachment

A healthy attachment style established in early life, characterized by trust, a sense of security, and a positive view of self and others.

Q21: Are there differences in neurotransmitter expression between

Q61: The use of debt in a firm's

Q104: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What

Q137: If a firm acquires more long-term debt

Q164: Earnings per share is equal to:<br>A) Net

Q180: Relationships determined from a firm's financial information

Q189: Cash flow from assets is equal to

Q236: Which of the following is not a

Q284: Dividends per share:<br>A) Increases as the net

Q336: Operating cash flow is best described as:<br>A)