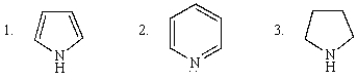

The decreasing order of basicity of the following is:

Definitions:

AGI

Adjusted Gross Income, an individual's total gross income minus specific deductions, used in the United States tax system to determine taxable income.

Dependent Daughters

This term is not an official tax term but generally refers to daughters who qualify as dependents on someone's tax return due to financial support and other IRS criteria.

AGI

Adjusted Gross Income, which is gross income minus allowable deductions, used to determine taxable income on an individual's federal income tax return.

Modified AGI

Adjusted Gross Income adjusted by adding back certain deductions, often used to determine eligibility for various tax credits and retirement plans.

Q4: Which of the following statements about the

Q7: In Drosophila, the genes y (yellow body)and

Q13: Mutation of a mouse gene results in

Q20: When 1-bromobutane is reacted with the bulky

Q23: The IUPAC name for <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7360/.jpg" alt="The

Q27: The repeating unit of polypropylene is:<br>A) <img

Q31: The S<sub>N</sub>2 mechanism for nucleophilic substitution reactions<br>A)

Q40: The organic product of the reaction <img

Q43: The reaction of a Grignard reagent with

Q54: In Drosophila, singed bristles (sn)and cut