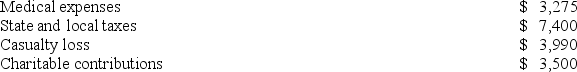

Mr.and Mrs.Hunt have the following allowable itemized deductions this year.

Determine the effect on the amount of each deduction if the Hunts engage in a transaction generating $10,000 additional AGI this year.

Determine the effect on the amount of each deduction if the Hunts engage in a transaction generating $10,000 additional AGI this year.

Definitions:

Base Year

A specific year chosen as a point of comparison for financial or economic data over time.

Current Position Analysis

The evaluation of a company’s ability to pay its current liabilities.

Short-Term Creditors

Entities or individuals who have provided financial credit to a company with the expectation of being repaid within a short period, usually within a year.

Comparative Financial Statements

Financial statements that present the financial position, results of operations, and cash flows of an entity for multiple periods side-by-side for comparison.

Q23: The United States taxes its citizens on

Q32: The confidence to take on and put

Q37: Which type of audit can be handled

Q45: Three years ago,Mr.Lewis paid $40,000 for a

Q46: The unextended due date for the individual

Q52: Gretchen's 2018 tax return,due April 15,2019,was filed

Q63: Mr.and Mrs.Bolt's joint return reports $267,500 AGI,which

Q78: Mr.and Mrs.Liddy,ages 39 and 41,file a joint

Q89: Mr.and Mrs.Perry own stock in an S

Q94: According to Public Law 86-272,the sale of