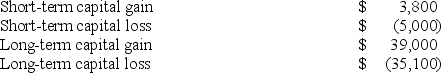

Tom Johnson,whose marginal tax rate on ordinary income is 22%,sold four investment assets resulting in the following capital gains and losses.  How much of Tom's net capital gain is taxed at 15%?

How much of Tom's net capital gain is taxed at 15%?

Definitions:

Scapula

The scapula, or shoulder blade, is a large, flat, triangular bone located in the upper back on each side of the vertebral column.

Humerus

The long bone in the upper arm that runs from the shoulder to the elbow, connecting the scapula to the bones of the forearm.

Xiphoid Process

The smallest and lowermost part of the sternum, varying in shape and size, often cartilaginous in early life before ossifying in adulthood.

Stress Fracture

A small crack in a bone often caused by overuse or repetitive force, most common in weight-bearing bones of the lower leg and foot.

Q14: Mr.and Mrs.Shohler received $25,200 Social Security benefits

Q16: An individual who wants to roll over

Q19: Mr.Scott,age 46,quit his job with MNP Inc.and

Q33: The federal tax law considers the member

Q74: Mrs.Fuente,who has a 37% marginal tax rate

Q74: Mr.and Mrs.King had only one casualty loss

Q75: A taxpayer who knowingly signs a joint

Q89: Which of the following statements regarding alternative

Q133: Work engagement is characterized by vigour, absorption,

Q176: Which of the following is NOT associated