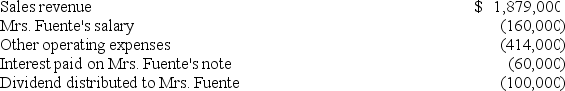

Mrs.Fuente,who has a 37% marginal tax rate on ordinary income,is the sole shareholder and CEO of Furey Inc.She also holds a $1 million interest-bearing note issued by Furey.The corporation's current-year financial records show the following:  Compute Mrs.Fuente's tax on her income from Furey.(Ignore payroll taxes in your calculations.)

Compute Mrs.Fuente's tax on her income from Furey.(Ignore payroll taxes in your calculations.)

Definitions:

Intimidation

A threat to perform an illegal act that is used to force a party to act against its own interest.

Illegal Activity

Actions or endeavors that are prohibited by law and subject to criminal penalties.

Unfair Competition

Business conduct deemed unethical or deceptive, infringing on another's business rights or attempting to mislead consumers.

Intimidation

The act of making someone fearful or overawed, especially in order to influence their behavior or decisions.

Q17: Which of the following statements regarding S

Q27: Blitza Inc.owned real property used for 12

Q32: Poppy's book income of $739,300 includes a

Q39: Lincoln Corporation,a U.S.corporation,owns 50% of the stock

Q52: Albany,Inc.does business in states C and D.State

Q54: Mrs.Beld sold marketable securities with a $79,600

Q65: Transfers of equity interests to family members

Q72: Gabriel operates his business as a sole

Q97: Both corporate and individual taxpayers can carry

Q99: Mrs.Brinkley transferred business property (FMV $340,200; adjusted