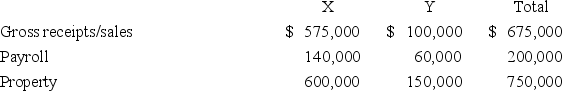

Origami does business in states X and Y.State X uses an equally-weighted three-factor apportionment formula and has a 4 percent state tax rate.State Y uses an apportionment formula that double-weights the sales factor and has a 6 percent tax rate.Origami's taxable income,before apportionment,is $3 million.Its sales,payroll,and property information are as follows.

a.Calculate Origami's apportionment factors,income apportioned to each state,and state tax liability.

a.Calculate Origami's apportionment factors,income apportioned to each state,and state tax liability.

b.State Y is considering changing its apportionment formula to a single sales factor.Given its current level of activity,would such a change increase or decrease Origami's state income tax burden? Provide calculations to support your conclusion.

Definitions:

Paraphrase

The restating of text or speech using different words, often to achieve greater clarity or to change the emphasis.

Invite Clarification

To request further explanation or more detailed information in order to understand something more clearly.

Free Association

A psychoanalytic technique in which a patient says whatever comes to mind without censorship as a way of exploring the unconscious mind.

Active Listening

A communication technique involving listening attentively with all senses, reflecting, and providing feedback to ensure understanding.

Q21: Maxwell,Inc.had taxable income of $2,500,000 for its

Q49: The general rule is that a net

Q49: Last year,Mr.Margot purchased a limited interest in

Q55: A foreign source dividend received by a

Q58: Tibco Inc.exchanged an equity interest in ABM

Q60: Which of the following statements about tax

Q71: The standard deduction for single individuals equals

Q73: Skeen Company paid $90,000 for tangible personalty

Q75: A foreign branch operation of a U.S.corporation

Q86: N&B Inc.sold land worth $385,000.The purchaser paid