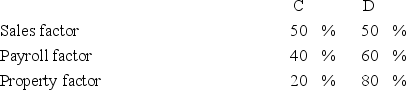

Albany,Inc.does business in states C and D.State C uses an apportionment formula that double-weights the sales factor; state D apportions income using an equally-weighted three-factor formula.Albany's before tax income is $3,000,000,and its sales,payroll,and property factors are as follows.  Calculate Albany's income taxable in each state.

Calculate Albany's income taxable in each state.

Definitions:

Correlations

Statistical measures that indicate the extent to which two or more variables fluctuate together.

Cognitive Psychologists

Scientists who study the mental processes underlying perception, thought, learning, memory, and decision-making.

Mental Represent

The mental imagery or symbolic representation of objects, events, or concepts in the mind.

Perception

The process by which organisms interpret and organize sensory information to represent and understand the environment.

Q25: Investment expenses are an itemized deduction.

Q33: Mr.and Mrs.Dell,ages 29 and 26,file a joint

Q36: When a closely held business is formed

Q37: Weston Corporation has accumulated minimum tax credits

Q37: Milton Inc.recognized a $16,900 gain on sale

Q45: Which of the following is not a

Q64: Ms.Kilo's regular income tax before credits on

Q67: Sandy Cole realized a loss on sale

Q87: Which of the following is a consequence

Q102: Charlie is single and provides 100% of