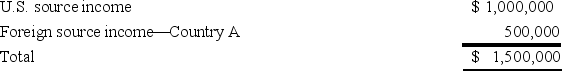

Fleming Corporation,a U.S.multinational,has pretax U.S.source income and foreign source income as follows:  Fleming paid $50,000 income tax to Country A.If Fleming takes the foreign tax credit,compute its worldwide tax burden as a percentage of its pretax income.

Fleming paid $50,000 income tax to Country A.If Fleming takes the foreign tax credit,compute its worldwide tax burden as a percentage of its pretax income.

Definitions:

Work Issues

Challenges or problems encountered in the workplace, affecting employee performance or satisfaction.

Primary Intervention

Preventive strategies or actions taken to address potential issues before they become significant problems, often used in healthcare, psychology, and education.

Mental Health

A state of well-being in which an individual realizes their own abilities, can cope with the normal stresses of life, can work productively, and is able to make a contribution to their community.

Career Counseling

A guidance process that helps individuals understand their interests, strengths, values, and skills to make informed career-related decisions.

Q3: This year,Larry was awarded a bonus by

Q24: Mrs.Brinkley transferred business property (FMV $340,200; adjusted

Q28: Corporations are allowed a deduction for charitable

Q46: Gerry is the sole shareholder and president

Q47: Brokerage fees paid when stock is purchased

Q52: Albany,Inc.does business in states C and D.State

Q73: Which of the following statements about an

Q85: The purpose of Schedule M-1 is to

Q91: Because a QBI deduction affects AGI,it may

Q106: The foreign tax credit is available for