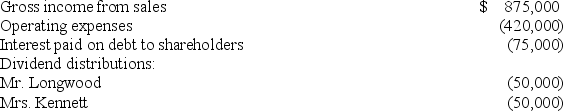

Mr.Longwood and Mrs.Kennett are the equal shareholders in LK Corporation.Both shareholders have a 37 percent marginal tax rate on ordinary income.LK's financial records show the following:

a.Compute the combined tax cost for LK,Mr.Longwood,and Mrs.Kennett attributable to LK's operations.

a.Compute the combined tax cost for LK,Mr.Longwood,and Mrs.Kennett attributable to LK's operations.

b.How would your computation change if the interest on the shareholder debt was $175,000 and LK paid no dividends?

Definitions:

Identical Conditions

Conditions that are exactly the same in every way, often used in experiments to ensure consistency.

Visual Feedback

Information provided visually that informs the user or viewer about the outcomes of actions, responses, or changes in the environment or system.

Videotape

A magnetic tape used for recording and replaying visual and audio information, now largely obsolete due to digital media.

Facial Reactions

Expressive movements of the face that communicate emotional states or reactions to stimuli.

Q10: Lovely Cosmetics Inc.incurred $785,000 research costs on

Q11: Tradewinds is a Bermuda corporation that is

Q14: Mr.Allen,whose marginal tax rate is 37%,owns an

Q33: A partnership is an unincorporated business activity

Q36: Mr.Wang's corporate employer transferred him from its

Q39: The accumulated earnings tax is imposed on

Q39: Matthew earned $150,000 in wages during 2019.FICA

Q67: This year,Mr.and Mrs.Lebold paid $3,100 investment interest

Q90: Generally,the corporate income tax is computed using

Q99: Frederick Tims,a single individual,sold the following investment