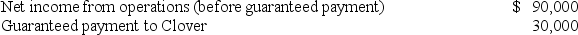

Hay,Straw and Clover formed the HSC Partnership,agreeing to share profits and losses equally.Clover will manage the business for which he will receive a guaranteed payment of $30,000 per year.Cash receipts and disbursements for the year were as follows  What is Clover's share of the partnership's ordinary income and guaranteed payment?

What is Clover's share of the partnership's ordinary income and guaranteed payment?

Definitions:

Sociology

The study of society, social institutions, and social relationships, analyzing the structure of societies and how individuals interact within these contexts.

Social Theory

Frameworks used to study and interpret social phenomena, focusing on patterns of social relationships, interaction, and culture.

Commodity Consumption

The process of purchasing and using goods and services that are available in the market.

Production

The process of creating goods and services through the combinatioN. of human labor, materials, and technology.

Q8: Accurate measurement of taxable income is the

Q20: Hay,Straw and Clover formed the HSC Partnership,agreeing

Q23: Airfreight Corporation has book income of $370,000.Book

Q39: Teco Inc.and MW Company exchanged like-kind assets.Teco's

Q48: Which of the following amounts are not

Q50: Which of the following statements about the

Q53: Laine Services,a calendar year taxpayer,billed a client

Q66: Liston,Inc.had taxable income of $1 million for

Q93: Miss Blixen's regular income tax is $77,390,and

Q106: JebSim Inc.was organized on June 1 and