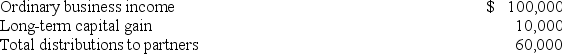

Mutt and Jeff are general partners in M&J Partnership and share profits and losses equally.Partnership operations for the current tax year were:  Mutt's tax basis in his partnership interest at the beginning of the current year was $12,000.What is his basis at the beginning of next year?

Mutt's tax basis in his partnership interest at the beginning of the current year was $12,000.What is his basis at the beginning of next year?

Definitions:

Relatively Cheap

A term used to describe goods or services that are considered to be priced lower than their perceived value or compared to alternative options.

Prospect Theory

A psychological theory that describes how people choose between probabilistic alternatives that involve risk, where the probabilities of outcomes are known.

"Low Fat" Sour Cream

Sour cream that has been modified to contain a lower fat content than traditional sour cream.

Dairy Barn

A specific type of barn used primarily for housing dairy cows and equipment for the production of milk.

Q12: A temporary difference between book income and

Q25: Fleet,Inc.owns 85% of the stock of Pete,Inc.and

Q33: Mr.and Mrs.Dell,ages 29 and 26,file a joint

Q37: For dividends received prior to 2018,the deemed

Q54: Mrs.Beld sold marketable securities with a $79,600

Q60: A fire destroyed business equipment that was

Q69: All types of business and investment real

Q88: PPQ Inc.wants to change from a hybrid

Q99: Murray Inc.,a calendar year,accrual basis corporation,accrued $946,000

Q106: JebSim Inc.was organized on June 1 and