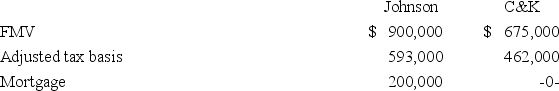

Johnson Inc.and C&K Company entered into an exchange of real property.Here is the information for the properties to be exchanged.  Pursuant to the exchange,C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property.Compute Johnson's gain recognized on the exchange and its tax basis in the property received from C&K.

Pursuant to the exchange,C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property.Compute Johnson's gain recognized on the exchange and its tax basis in the property received from C&K.

Definitions:

Consolidated Financial Statements

Financial statements that integrate the financial information of a parent company with its subsidiaries to present the financial performance and position of the entire group as a single entity.

Legal Entities

Organizations or structures recognized by law as capable of having rights and duties, such as corporations, partnerships, and trusts.

Parent Company

A company that has controlling interest in another company or companies, known as subsidiaries.

Subsidiary

A company that is controlled by another company, known as the parent company, through ownership of more than half of its voting stock.

Q4: Assuming a 21% marginal tax rate,compute the

Q13: If a corporation has accumulated minimum tax

Q14: Lawes Company,a cash basis business,mailed a $24,500

Q32: George and Martha formed a partnership by

Q34: Slumar,an accrual basis,calendar year corporation,reported $7,289,200 net

Q73: The Quad affiliated group consists of Quad,a

Q78: If a U.S.multinational corporation incurs start-up losses

Q86: Slipper Corporation has book income of $500,000.Book

Q96: If a business is formed as a

Q115: On December 19,2019,Logo Inc.,an accrual basis corporation,accrued