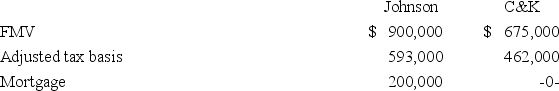

Johnson Inc.and C&K Company entered into an exchange of real property.Here is the information for the properties to be exchanged.  Pursuant to the exchange,C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property.Compute Johnson's gain recognized on the exchange and its tax basis in the property received from C&K.

Pursuant to the exchange,C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property.Compute Johnson's gain recognized on the exchange and its tax basis in the property received from C&K.

Definitions:

Elder

Refers to an individual of a greater age, often known for wisdom and leadership within a community or family.

Collateral Sources

Alternative or secondary sources of information or finance that can be used when primary sources are unavailable.

Applied Psychology

The field of psychology concerned with applying psychological principles and research to solve practical problems in human behavior and experience.

South Africa

A country located at the southern tip of Africa, known for its diverse cultures, languages, and significant historical contexts.

Q7: A bilateral agreement between the governments of

Q11: B&B Inc.'s taxable income is computed as

Q29: Fallon Inc.,a U.S.corporation,owns stock in several foreign

Q35: The topical index of a commercial tax

Q48: Norbett Inc.generated $15,230,000 ordinary taxable income and

Q52: Firm F purchased a commercial office building

Q63: Kaskar Company,a calendar year taxpayer,paid $3,350,000 for

Q65: Mr.and Mrs.Reid reported $1,435,700 ordinary taxable income

Q65: Which of the following statements regarding Internal

Q74: Mrs.Brinkley transferred business property (FMV $340,200; adjusted