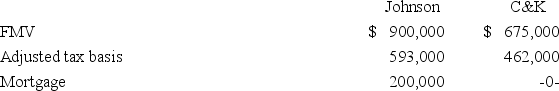

Johnson Inc.and C&K Company entered into an exchange of real property.Here is the information for the properties to be exchanged.  Pursuant to the exchange,C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property.Compute C&K's gain recognized on the exchange and its tax basis in the property received from Johnson.

Pursuant to the exchange,C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property.Compute C&K's gain recognized on the exchange and its tax basis in the property received from Johnson.

Definitions:

Dendritic Spine Density

A measurement of the number of protrusions (spines) on dendrites, which are indicative of the number of synaptic connections and plasticity of neurons.

Occipital Lobe

A region of the brain located at the back of the cerebral cortex, responsible for processing visual information.

Parietal Lobe

Part of the cerebral cortex that directs movements toward a goal or to perform a task, such as grasping an object; lies posterior to the central sulcus and beneath the parietal bone at the top of the skull.

Assembling Puzzles

The cognitive and motor activity involving fitting pieces together to form a whole picture or solve a problem.

Q5: Molton Inc.,which operates a chain of retail

Q18: Waters Corporation is an S corporation with

Q50: Southlawn Inc.'s taxable income is computed as

Q63: Yelano Inc.exchanged an old forklift used in

Q65: Dorian,a calendar year corporation,purchased $1,568,000 of equipment

Q76: Which of the following statements concerning extensions

Q78: Assuming that the corporation has a 21%

Q89: Keagan Company,a calendar year taxpayer,incurred $1,490 of

Q92: When a corporation is thinly capitalized,the IRS

Q95: Following the Tax Cuts and Jobs Act