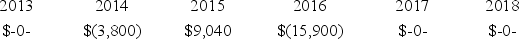

Proctor Inc.was incorporated in 2013 and adopted a calendar year.Here is a schedule of Proctor's net Section 1231 gains and (losses) reported on its tax returns through 2018.  In 2019,Proctor recognized a $25,000 gain on the sale of business land.How is this gain characterized on Proctor's tax return?

In 2019,Proctor recognized a $25,000 gain on the sale of business land.How is this gain characterized on Proctor's tax return?

Definitions:

H8/f7 Fit

A specific tolerance class designation for holes (H8) and shafts (f7) in engineering, ensuring a precise interference fit.

Basis

The underlying support or foundation for an idea, argument, or process; in materials, it could refer to the primary component or substance that forms the starting point.

Tolerance Position Letters

In engineering, symbols used in geometric dimensioning and tolerancing to represent the permissible limits of variation in the position of parts.

External Dimensions

Refers to measurements that describe the outer limits or size of an object or component.

Q3: Ferelli Inc.is a calendar year taxpayer.On September

Q6: On July 2,2019,a tornado destroyed an asset

Q11: Assume that Congress recently amended the tax

Q11: B&B Inc.'s taxable income is computed as

Q15: A taxpayer who realizes a loss on

Q28: A fire destroyed equipment used by BLP

Q37: Selkie Inc.paid a $2 million lump sum

Q43: In its first taxable year,Platform,Inc.generated a $100,000

Q44: Bolton Inc.,a calendar year taxpayer,generated a $296,400

Q55: Understal Company has $750,000 to invest and