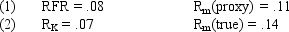

Assume that as a portfolio manager the beta of your portfolio is 1.3 and that your performance is exactly on target with the SML data under condition 1. If the true SML data is given by condition 2, how much does your performance differ from the true SML?

Definitions:

Industry

An industry is a group of companies that are related based on their primary business activities.

Local Currency Return

The return on an investment denominated in the currency of the country where the investment is made.

Stock Market

A public marketplace for buying and selling stocks, which represent ownership claims on businesses.

Total Revenue

The total amount of money generated by a company from its business activities, before any expenses are subtracted.

Q20: Antiques, art, coins, stamps, jewelry, etc., are

Q26: All of the following are ways in

Q64: Which of the following is not a

Q72: There is a high correlation between the

Q75: Studies of correlations among monthly U.S. bond

Q83: An example of a value weighted stock

Q86: All of the following are characteristics of

Q92: Refer to Exhibit 7.8. What is the

Q104: An investor wishes to construct a portfolio

Q108: Which of the following is not a