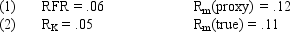

Assume that as a portfolio manager the beta of your portfolio is 1.4 and that your performance is exactly on target with the SML data under condition 1. If the true SML data is given by condition 2, how much does your performance differ from the true SML?

Definitions:

Deposit

Money placed into a financial institution for safekeeping or in order to earn interest.

Annually

Pertaining to a period or event that occurs once every year.

Classic Automobile

A vintage or antique car often considered valuable due to its historical significance or rarity.

Valued

The importance, worth, or usefulness of something, often in terms of monetary worth.

Q32: Which of the following variables were found

Q41: Tests have shown that if small filters

Q41: All of the following are advantages of

Q41: Refer to Exhibit 8.5. Which of the

Q51: Refer to Exhibit 4.3. If the maintenance

Q57: A return series has an arithmetic mean

Q66: Refer to Exhibit 10.9. Calculate the total

Q96: Refer to Exhibit 7.9. What is the

Q97: Which of the following variables was considered

Q113: Assume the risk-free rate is 4.5% and