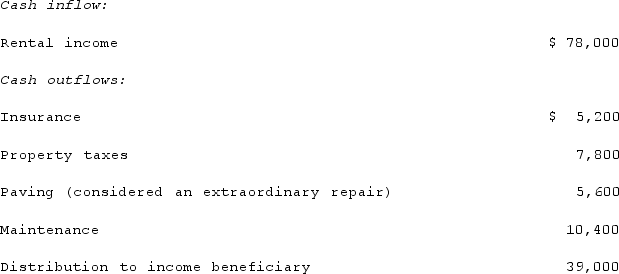

An inter vivos trust was created by Isaac Posney. Isaac owned a large department store in Juggins, Utah. Adjacent to the store, Isaac also owned a tract of land that was used as an extra parking lot when the store was having a sale or during the Christmas season. Isaac expected the land to appreciate in value and eventually be sold for an office complex or additional stores. Isaac placed the land into a charitable lead trust, which would hold the land for ten years until Isaac's son would turn 21. At that time, title would be transferred to the son. The store will pay rent to use the land during the interim. The income generated each year from this usage will be given to a local church. The land was currently valued at $416,000.During the first year of this arrangement, the trustee recorded the following cash transactions:  Required:Prepare all required journal entries for this trust fund including the entry to create the trust.

Required:Prepare all required journal entries for this trust fund including the entry to create the trust.

Definitions:

Annual Impairment Test

A review conducted yearly to determine if an asset's carrying value exceeds its recoverable amount, leading to an adjustment if necessary.

Tax-loss Carryforwards

A provision in the tax code that allows an individual or company to use losses from one year to offset future profits for tax purposes.

External Growth

Expansion of a company's operations through acquisitions, mergers, or partnerships, rather than through organic growth.

Avoid Paying Dividends

Strategies employed by companies to retain earnings instead of distributing them to shareholders as dividends, often to reinvest in the business or improve balance sheet health.

Q1: Unconditional transfers of cash or other resources

Q5: Goodman, Pinkman, and White formed a partnership

Q73: What is the purpose of government-wide financial

Q78: Which of the following are positive economic

Q222: Society faces a trade-off in all of

Q253: The sales revenue a seller receives from

Q283: When voluntary exchange takes place, both parties

Q287: The term "market" refers only to trading

Q349: The relationship between sales and revenue is<br>A)

Q371: Fiona shares an office with her ex-husband.