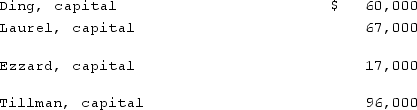

A local partnership was considering the possibility of liquidation. Capital account balances at that time were as follows. Profits and losses were divided on a 4:2:2:2 basis, respectively.  At that time, the partnership held noncash assets reported at $360,000 and liabilities of $120,000. There was no cash on hand at the time.If the assets could be sold for $228,000 and there are no liquidation expenses, what is the amount that Tillman would receive from the liquidation?

At that time, the partnership held noncash assets reported at $360,000 and liabilities of $120,000. There was no cash on hand at the time.If the assets could be sold for $228,000 and there are no liquidation expenses, what is the amount that Tillman would receive from the liquidation?

Definitions:

IT Selection

The process of choosing the appropriate information technology systems and tools that meet the unique needs and objectives of an organization.

Dashboards

Interactive and visual display panels that consolidate and present data in real-time, allowing users to monitor and analyze information efficiently.

Performance Indicators

Metrics used to evaluate the effectiveness, efficiency, and success of an organization's activities.

Business Strategy

A plan of action designed to achieve specific goals and objectives in the business environment.

Q5: Goodman, Pinkman, and White formed a partnership

Q25: All of the following are true about

Q29: Assume the partnership of Dean, Hardin, and

Q30: What is meant by "an individual dies

Q31: What criteria did the FASB establish for

Q34: For what is a special revenue fund

Q68: Which entry would be the correct entry

Q101: A subsidiary of Reynolds Inc., a U.S.

Q300: In economics, the accumulated skills and training

Q381: The development of a new good or